This site may contain affiliate links, view the Disclaimer for more information.

This post is all about how to have a no spend month in 5 easy steps.

As consumers, we buy and waste so many products. From beauty supplies, eating out, toys, snacks, and more. We often blow our budgets and have nothing to show for it.

We all need to whip our budgets back into shape and back on track. Myself included, we need to challenge ourselves to limit our spending especially if we want to make healthy financial decisions.

I recently went to Target and bought a new mug for my office. I did NOT need that mug and I have a thousand mugs already at home. Instead that $3.99 plus tax could have gone to savings or towards the debt I have.

Now, I also believe we all should have fun and not make ourselves miserable trying to save and reduce debts. (Life is short) However, It is also just as important to remember your financial goals and to tackle debts.

This post is all about a no spend month.

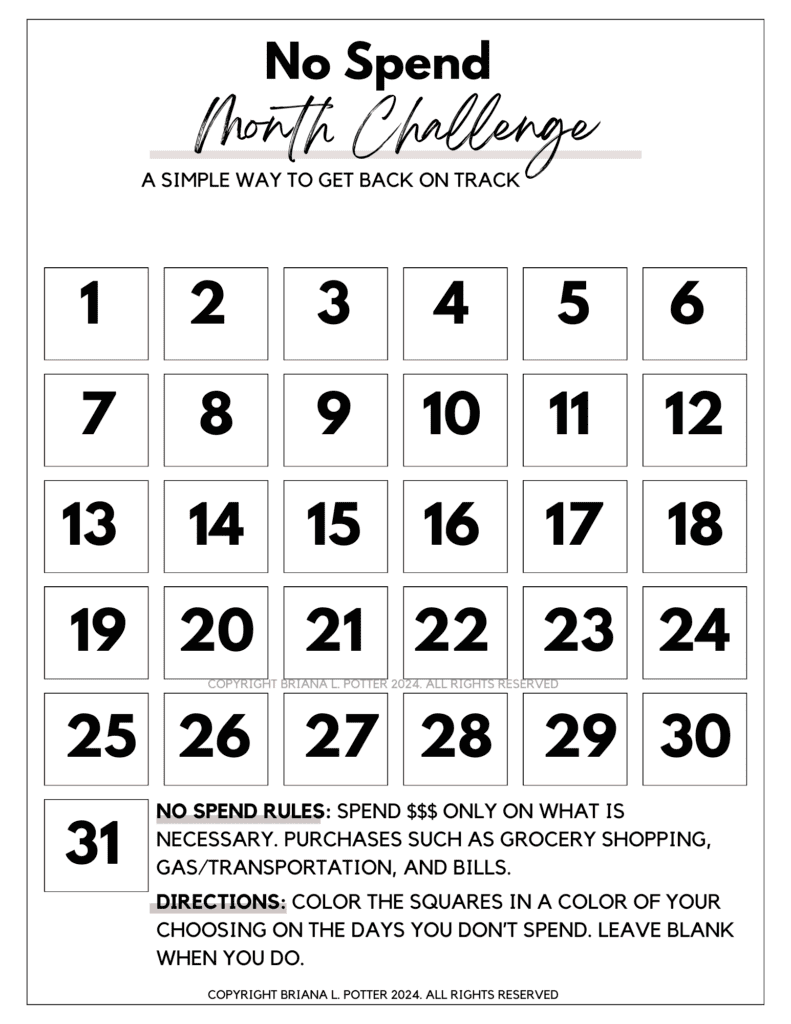

No Spend Challenge + FREE Printable at the bottom!

What is a No Spend Month?

A no spend month or challenge is when you pay only for essentials for a set amount of time. It is normally 30 days (or a month) long. However, I have seen it be as extreme as a year or as little as two weeks.

[Related Post: 5 Best Ways to Save Money Each Month]

Essentially you are saying no to fun (don’t worry, it’s temporary) but saying yes to extra money for savings or debt. You’ll be covering only: food, utilities, housing, and transportation expenses for the month.

Why is this necessary?

There are a lot of reasons to participate in a no spend challenge. But some of the main points are:

Aren’t you ready to see a difference in your budget?

How to Set up The No Spend Month:

The rules are super simple and ultimately up to you. Customize however you need to fit your lifestyle and family’s needs.

1. Determine the length of time for the challenge

Typically you would do a month but it is not a hard rule. You can set for a weekend, or every weekend, two weeks, or even a day. The point is to reduce your spending and have some extra money in your pockets.

You can go hardcore and do a no spend year or 6 months. I want to do this after my birthday in July.

2. All or something?

Determine what your no spend month category is. Will you only limit spending to just your basic living needs? Or will you limit spending to spending nothing on clothing, makeup, or whatever it is you tend to overspend?

3. Prepare for the spending freeze challenge

Whatever length of time and category you have chosen, it’s best to set you up for success. Make sure you have all the clothes you need, food stocked up (to avoid eating out because you have no food), and proper shoes, etc.

Nothing ruins the challenge more than forgetting you have to purchase something during your challenge.

4. Remember your why

As the name implies, not spending any extra money is meant to challenge you. You’ll be saying no to friends, family, and what will feel like all fun. However, remember why you even started the challenge in the first place.

Don’t forget that it is also temporary. So although your friends may be at the mall or the bar without you, you’ll have a little extra cash to save for a rainy day.

5. Have Fun

Try to take this challenge in a fun and positive light. Turn it into a game and find little ways to reward yourself or occupy your time by discovering new hobbies at home. You might be surprised at how much fun you are having by KEEPING your money.

Simply put: BUY ONLY WHAT YOU TRULY NEED WHEN YOU TRULY NEED IT

Specific Rules for my No Spend Month Challenge

No eating out/Buying groceries outside set budget

Don’t go to Amazon or Target

no clothes

don’t purchase toys, books, or entertainment

no trips to the makeup aisle or ulta

No Spend Challenge Extras

What if I have to purchase food?

This challenge is not meant for you to starve yourself or your family. However, I will bet money that you can get creative with what’s already in the house.

What if I have gift cards?

Use them! However, limit yourself to what’s exactly on the gift card. If it will cause you to go over, then wait until your no spend month is over.

Someone’s birthday came up during the challenge, what should I do?

This is where you should have planned to account for that day. However, don’t feel bad or guilty that you may have to buy a birthday gift. Remember, you also set the rules so you can break them too 😉

I spent money on something I should not have, what now?

No need to worry too much, simply write a note or mark on the day that it happened and simply try again. Don’t let one mistake jeopardize your entire month.

Let’s be accountability partners in this No Spend Month Challenge!

Download and print this completely free spending tracker! Color each day you have a successful no-spend day in whatever color you choose and leave the unsuccessful days blank.

Leave a comment if you participated in the challenge, I would love to see what progress was made. Also, what did you do with the extra money?

This post was all about a no spend month challenge.

One Comment

Comments are closed.