This site may contain affiliate links, view the Disclaimer for more information.

Today, let us chat about something that might not be a comfortable topic. This post is all about 11 reasons every family needs emergency savings.

As much as we would rather talk about the latest parenting hacks or adorable toddler fashion trends, having an emergency savings plan is equally important.

When it comes to securing your family’s future; emergency savings is not to be overlooked. As a mom who’s been through her fair share of unexpected twists, turns, and bills. According to Bankrate, as of 2023, only about 30% of people have emergency savings but not enough to cover at least 3 months’ expenses.

This means a lot of people are one or two paychecks away from a financial disaster. Here are 11 reasons why every family needs to have emergency savings.

1. Unpredictable Medical Expenses

Kids are full of surprises and so are their various health needs. From unexpected urgent care visits to those late-night emergency room trips, having a financial cushion can ease the pressure on your wallet. Allowing you to focus solely on your child’s health.

We all know there are also expenses that health insurance won’t cover. However, at the moment no parent is thinking about that bill. Making sure you have a nest egg in savings allows you to be present.

2. Job Loss or Income Reduction

Life is unpredictable and job security is never guaranteed. An emergency fund provides a safety net if you or your partner face unexpected unemployment or a setback in income.

Losing a source of income is stressful no matter what. But if you have a partner who is the sole provider, that can add even more stress. Because well–your lifestyle relies on their income.

Other Posts You May Enjoy:

5 Best Ways to Save Money Each Month

Sinking Funds: The Best Way to Achieve Your Financial Goals

I stepped down from my job to stay at home with our children (daycare for two was just insane). Although it was planned, we were still losing an income and it would’ve been a lot smoother if we had a better emergency savings plan.

3. Home Repairs

Owning a home brings joy, but it also comes with unexpected expenses. Whether it’s a leaky roof or a malfunctioning HVAC system, having savings set aside can prevent these surprises from turning into financial disasters.

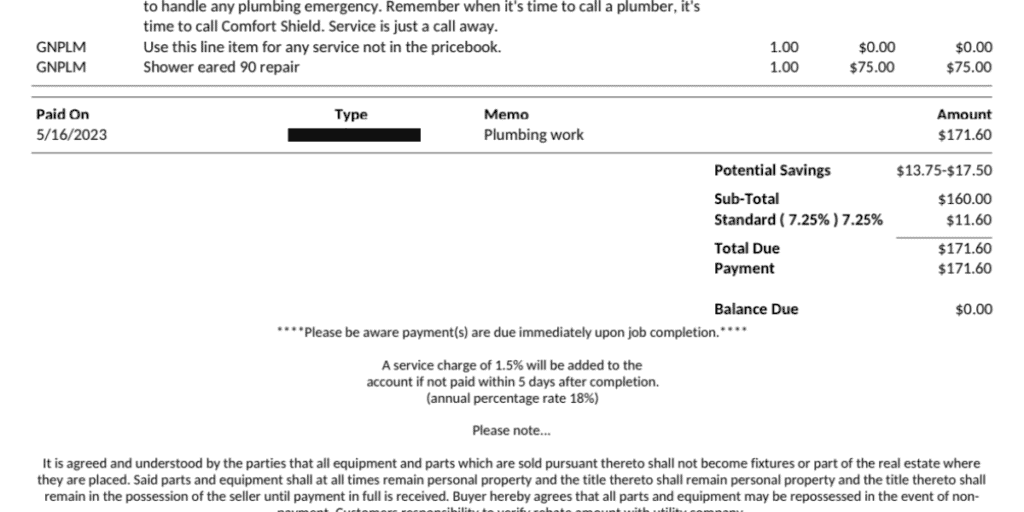

I had to call a plumber to look at our leaky shower and backed-up drain that store-bought Drain-O couldn’t solve. Even though it wasn’t overly expensive, that was still $170….down the drain.

4. Car Troubles

Us moms know that reliable transportation is mandatory to keep the family on the move. An emergency fund can cover unexpected car repairs, ensuring your family stays safe and mobile.

Like the time my car decided to have a flat tire way before I was ready to replace a tire. Without having savings (at the time), it pushed us to open up a credit line at an outrageous interest rate.

5. Natural Disasters

Mother Nature doesn’t always play nice. From hurricanes to earthquakes, having a financial buffer can help your family weather the storms. By having a plan to cover evacuation costs, temporary shelter, and unexpected expenses you’ll have a smoother transition.

6. Family Emergencies

Sometimes, family members face unexpected challenges, and you may need to provide support. Having emergency savings ensures you can be there for your loved ones when they need it most.

Unfortunately, we lose loved ones or maybe they become too sick to care for themselves. Having that money in the bank will allow you to care for or see them one last time. Grief is hard enough, lack of money shouldn’t make it harder.

7. Unexpected Travel

Life doesn’t pause for family vacations or reunions. Having an emergency fund allows you to travel at a moment’s notice without breaking the bank.

8. Appliance Breakdowns

It seems like household appliances have a mind of their own. When the dishwasher floods the kitchen or the refrigerator calls it quits, an emergency fund can rescue you from unexpected replacement costs.

Our oven decided after 6 years, it was time to quit working. I was making hot wings for lunch and my timer went off. I went to grab my wings and realized it NEVER cooked them.

We luckily could simply replace a couple of cheap parts and she was working again. Imagine if we had to replace the whole oven.

9. Sudden Expenses for Kids

Kids grow fast, and so do their needs. Whether it’s unexpected school expenses, extracurricular activities, or a growth spurt that requires a whole new wardrobe, having savings can cover these surprise costs.

Babies also have a TON of doctor visits and mystery illnesses. And they aren’t always scheduled visits. I don’t need to remind any parent that they are expensive haha.

10. Legal Issues

Unfortunately, legal matters can arise when you least expect them. From traffic tickets to unforeseen taxes that you owe, having an emergency fund ensures you can handle legal issues without compromising your family’s financial stability.

I am a speed demon. Me and driving over the speed just belong together. However, the cops strongly disagree and because of that, I have a couple of tickets under my belt. Because these tickets are never in my monthly budget, they have had to come out of a savings account.

11. Peace of Mind

Perhaps the most crucial reason of all – having an emergency savings fund. Having a separate fund provides peace of mind. Knowing you have a financial safety net allows you to focus on what truly matters. Having your family’s financial well-being secure is something money can buy.

In this unpredictable journey of parenthood, having an emergency savings fund is like having a literal safety net.

This post was all about the 11 reasons to have emergency savings.