This site may contain affiliate links, view the Disclaimer for more information.

The idea of wasting money is a touchy subject. It can cause fights, divorces, anxiety, and many other uncomfortable feelings. However, money is nothing but a tool. It can also bring feelings of comfort, stability, peace, and more if you learn to manage it.

We are all currently living in a financial crisis. There is a constant fear of our finances, inflation, and the fact that a 2% yearly raise isn’t keeping up with the cost of living. Sprinkle in the fact that you can’t afford daycare and it’s no wonder, money seems to be at the root of our problems.

Trust me, I understand completely where you are coming from. I am a chronic waster of money (trying to reel my spending in for 2025). We can no longer let money negatively rule our lives. It’s time to take action and take control.

Here are several tips, tricks, and strategies that I found that not only helped me but I can guarantee they will help you too. This is not going to make you rich but it will help find a little more wiggle room.

This post is all about 21 smart strategies to stop wasting money in 2025.

Wasting Money FAQ

What is Wasting Money?

Wasting money means you have no idea where you are spending your dollars. You buy things to have it and you have no plans. You spend too much and carelessly.

How Can I Stop Wasting My Money?

Recognize that it’s okay and you are human. Start making financial plans to get better. Even if that means going to therapy, creating a budget, and finding support. You don’t have to go through this alone.

How to Deal With Wasting Money?

The first is to understand that you aren’t the first or the last person to waste money. The second is to feel no shame or guilt but recognize that it’s time for a change. We don’t judge because you never know how someone was brought up financially.

Can Spending Money Be an Addiction?

Anything can be an addiction. Shopping can provide dopamine hits and it feels good in the moment. Some people have shopping addictions. The good news is that like most addictions, a good program and support can help you beat it.

How do I Stop Spending so Much Money?

Making goals and plans for your money can help you recognize what’s an important purchase. Remove shopping apps and reduce how often you go into your favorite store. If you want to start a new business, purchase a new car, or save for your forever home, you’ll have to limit your spending habits.

Tips & Tricks

1. Unsubscribe from Tempting Offers

These offers are designed to grab your attention and play on your FOMO (fear of missing out). It plays on the idea of scarcity and counts on you to make an impulsive purchase.

Stop cluttering your inbox and notifications with sales, discounts, and limited time only. Challenge yourself to see how much money you can save by just clicking unsubscribe.

Bonus tip: Delete those shopping apps on your phones.

2. Make Savings a Game

Set up weekly, daily, or monthly challenges to save as much or spend as little as possible. You can challenge yourself to “no-spend challenges” or have an “under-budget week”.

The Budget Mom was a great help and she often has challenges like saving every 5 dollar bill you have. Her challenges are usually for a certain amount of time and fun! (Non-affiliate)

3. Shop With a List (& schedule pickups)

A list is a plan and it’s even better when you meal plan. Shopping without a list will 99.9% guarantee you overspend and grab food you didn’t need. Grocery stores are counting on that.

However, even with a plan sometimes it’s hard not to focus on the *new limited time only fall flavored creamer that comes once a year*. This is why I also schedule pickups. It is so much harder to overspend when you shop and schedule your groceries.

Don’t waste money on food and items you had to plan to buy in the first place. Grocery shopping is the biggest area where people waste money.

Want to remember this post for later? Pin for later! 👇🏾

4. Automate Savings

You can’t miss money that you never had access to. Create a budget and figure out a realistic amount you can deposit into your savings account each month or per paycheck. You eventually get addicted to the feeling of saving that it feels strange when you don’t.

5. Budgeting Finances (Zero-Based Budget)

In order to grab a complete handle on your finances you need a budget! There is no way around it. A budget tells your money where to go. Zeroing your budget out means you have accounted for every dollar that enters your checking account.

[Post you may like: How to Use The 70/20/10 Rule Budget The Right Way]

6. Use Cash Back Apps

Cash-back apps are just *a chef’s kiss*, if I’m going to spend the money anyway. I often use Ibotta for our groceries and my mom makes her money back (and sometimes they pay her!) by utilizing multiple apps.

Popular Cash Back Apps

Even check with who you have open lines of credit and/or bank with. Sometimes they have opportunities to earn cash back rewards.

7. Make your Own Coffee or Tea

There are 1,001 YouTube videos to show you how to make your favorite drink at home. Certain coffee shops even have grocery store beans and syrups to buy. Bonus points are that they are healthier since you can control what goes in them.

8. Make your Own Dog Treats

Along with making your pup a puppuccino, make them some specialty dog treats as well. The Dog Darling has tons of amazing DIY treats that you can make at home! You shouldn’t be the only one that can enjoy a pumpkin spice treat. (Non-affiliate)

Dog Treats can get insanely expensive and can contain harmful ingredients for your pup. Making your own at home can not only provide healthier options for them but kinder to your wallet as well.

Jennifer (The Dog Darling) is a dog mama through and through. If you have fur babies (or even fur grandbabies), then please check out her website! She has many tips and tricks that help you give them the best life.

9. Purchase Affordable Activities For Kids

Tackling your children’s boredom and making learning fun can be difficult. I am currently in my homeschool era and I needed guidance and affordable activities. Literacy and Play is one of my favorite sites to gain inspiration for homeschooling and she also has affordable digital products! A win-win! (Non-affiliate)

Joceline (Literacy and Play) utilizes Play-Doh (and many other fun toys), playful learning, and characters they love to foster joyous learning. She is a Christian mother who wants to share her love of homeschooling and teach you how you can as well.

10. DIY Household Cleaners & Reusable Cleaning Products

Paper towels can be costly if you aren’t careful. I have a mixture of cleaning towels for my sink and dishes but I use paper towels for the toilet. There are a lot of resources to create your own cleaners at home. With most of them using Dawn, white vinegar, baking soda, and essential oils you have at home. You’ll be able to create many cleaners.

Plus I have seen a lot of recipes where you can create laundry detergent that can last you 6 months to a year. It is powdered-based but cost-effective if bought in bulk.

11. Delay Upgrading New Tech

This is a biggie, especially with the upcoming iPhone 16 launch. I say this as someone who loved upgrading phones every year, please don’t. There is nothing wrong with the current model you have. If there is something wrong with it, then considered not the newest upgrade.

I have had my iPhone 11 Pro Max for about 5 years, and it’s starting to have issues. I have no plans to upgrade to the 16 but I may do the 15 and below. However, if your computer, AirPods, or even vehicle gets the job done, you should wait.

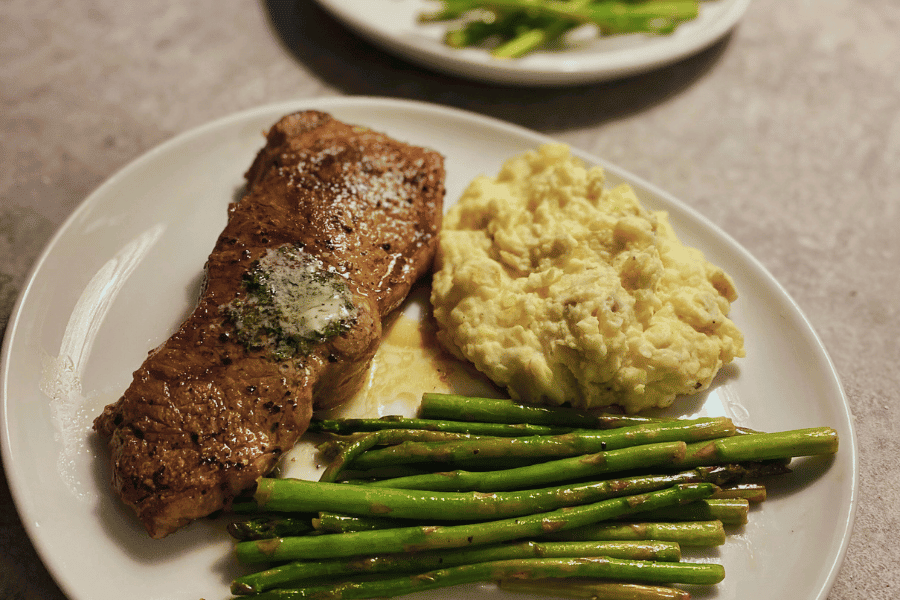

12. Make a New Recipe at Home

We all get bored of our usual routine meals. Making it so much easier to order takeout when you have food at home. Factor in trying something new and exciting when you grocery shop. This will give you something to look forward to and you can save the meal for a date night too.

My husband and I have saved so many Hello Fresh recipe cards for this reason. It feels like we are eating restaurant-quality food but it’s all made at home! We got (insert restaurant name here) at home!

13. Limit Credit Card Use

If you don’t know how to manage your credit card use, shred them. Credit cards can make you feel like you have extra money when you don’t. On top of the insane interest rates, this is a great way to spend extra money on products.

The shoes, clothes, and jewelry have been paid for twice because of interest. Shred them today and start paying higher amounts if you can. Use a credit card only in emergencies.

14. Use a Reusable Water Filter System

There are pretty home filter systems along with ones that go in the refrigerator or on the sink. I have saved tons of money by switching to filtered water at home and a reusable tumbler. There’s no longer a need to buy water bottles and it’s good for the Earth.

15. Avoid Buy Now, Pay Later Options

This payment style makes buying more attractive. For certain purchases that you were going to make anyway, this may be smart to hold on to your cash. However, it entices you into wasting money because of the lower payments.

16. Embrace a Simpler Life

Avoid lifestyle creep by living below your means. It’s tough in today’s society to avoid feeling like your life is enough. It is and it always was. Embrace living slower and simpler. You’ll save more money and you’ll be a lot happier.

17. Refinance Your Loans

Refinance your loans for a lower rate and potentially a lower interest rate. You can save more money in the long term and may be able to pay the debt off quickly.

18. Conserve Energy

You burn and waste so much electricity by leaving lights and fans in rooms no one is in. I’m sure you’ve had an energy bill that was astronomically high. Unplug anything you aren’t currently using and take advantage of natural sunlight.

Upgrade your home to a Smart home if possible to save in the long run. Invest in blackout curtains to help insulate your home.

19. Move Out of The City

There are pros and cons to living in the city vs a rural area. You have access to more amenities, education, resources, and job opportunities. However, because of that it is usually a higher cost of living. Mortgages and rent will leave you house-poor.

The best way to do this is to live right outside the city for the amenities and career but live in a modest, rural area home/apartment you can afford. Don’t feel bad if this is not feasible, it’s also expensive to move and uproot a family. Just keep this in mind should you get an opportunity to move.

20. Go to Community College

There’s no rush to make it to the big Ivy League school when you haven’t gotten your general classes out of the way. Take 2 years to get all those electives and general classes at a cheaper tuition and then transfer. The good thing is this will give you time to think before throwing money at a college and then deciding this isn’t for you.

School isn’t the only way to be successful and it’s easier to decide that if you don’t have $50,000 down the drain for just the first semester. Howvere, if you have a program to go for free, take full advantage of that.

21. Cancel Unused Subscriptions

You aren’t using them. They are taking money away from you. Whether you own a business or it’s personal cancel those subscriptions. When was the last time you used the Gym Membership app? OR the paid version of Peacock?

Delete them Right now!

Wasting money is a common problem for many people. From unused subscriptions to paying more for products they can DIY, there is a way to gain it back. Making conscious efforts to stop wasting money will help you gain control of your finances.

This post was all about smart strategies on how to stop wasting money.