This site may contain affiliate links, view the Disclaimer for more information.

I don’t know about you but I was tired of being caught off guard with expected and unexpected expenses. Not having sinking funds for car repairs, medical bills, and even gift buying were all stressful times.

Simply setting aside money, even a little bit each paycheck, will drastically change your life as you no longer have to worry about what you can afford. This post is all about the importance of fitting sinking funds into your budget.

What are Sinking Funds?

A sinking fund is a strategic way to set money aside for unexpected and expected expenses. Let me explain. No, it’s not an emergency savings and it’s not quite a regular savings account but an important part of your financial plan.

An emergency account is for unexpected emergencies like losing your job or you have to repair a blown water pipe. About half of Americans are ill prepared for emergencies and don’t even have $1000 in savings.

A regular savings account is more of a “giant bucket” and may not have a dedicated singular use. A savings account would be used for your longer-term goals; it’s where you save your money.

Instead, it’s multiple saving funds for very specific, dedicated, and singular purposes. For example, you could have a sinking fund just for birthday parties/gifts or have one for routine car upkeep. It allows you to set savings goals.

Sinking funds are what you are saving for or how to save your money. There’s no limit to the many sinking funds you can have and they can change month to month.

Why Have Sinking Funds?

Having a sinking fund can not only be fun and motivating but it’s incredibly beneficial to set up.

They are an excellent way to ensure you have cash for all your future purchases. It allows you to save small amounts each month instead of having to blow a single month’s budget.

- It allows you to save for anything and everything: Allow yourself to get as specific as you want and make sure it covers every need and want. A vacation, maybe a new car, or maybe the family needs new camping gear. Whatever it is you want to save up for.

- Plan for fun family trips: Never worry about not affording that trip to the Bahamas, Disney, or Universal Studios again. Bonus: No guilt when you are spending the money either and you can focus strictly on having fun.

- Prepare for those costly, inevitable purchases: Kitchen repair or remodel, new deck/patio, new tires that you knew you needed from your last service, or even be able to finally repair the roof from the storm—that was 5 years ago.

- Alleviates any reason to use a line of credit: This eliminates the need for having to break out a credit card or signing up for AfterPay because you don’t have the funds to purchase what you need/want.

- Eliminates impulse buys/buyer’s remorse: Having dedicated funds for all your goals keeps you in a positive spending mindset. You have the dedicated funds for this specific goal so you can spend happily.

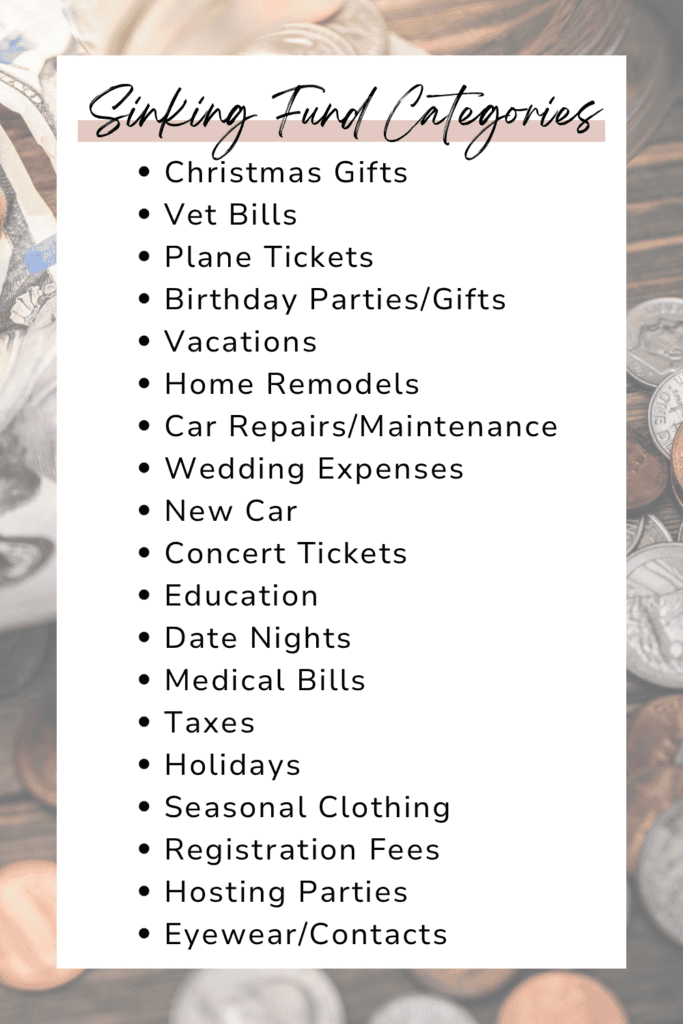

The image below has some examples of some of the best sinking fund categories you can add to your budget today:

You can create virtually any sinking fund to support your financial goals, dreams, or expenses. Life is actually easier, more enjoyable, and less stressful when you have specific purposes for your money.

My husband and I are currently in the process of setting up a vow renewal sinking fund. This will alleviate any guilt on spending the money. After all, its whole purpose is to be spent on a vow renewal. Also, once the money is spent, that is it. I cannot spend what the account does not have or I fall into debt.

See the magic of a sinking fund and why you should set one up, like today?

How to Create a Sinking Fund

Figure Out What You Need/Want to Save For

What are some of the needs and wants that are upcoming? Just recently engaged and planning a wedding? Need a new car soon or tires? Whatever it is, create a plan now so that future expenses don’t catch you off guard.

Decide How and Where You’re Keeping Your Savings

Are you stuffing a mattress or trusting a bank (I’d go with the bank)? There are different types of accounts you can keep your funds. Choose an account that has no monthly fees that’ll eat away at your balance or an account that has no minimum amount you must keep at all times.

How Much Do You Need to Save and by When?

Figure out the amount you need to have saved up and by when. For example, let’s say you want to travel to Italy for a vacation next year. Divide the amount you need by twelve months and you’ll have the amount you’ll need to save each month.

Include it in the monthly budget

Once you decided how, where, and why for your sinking funds, include it in your monthly budget. Whether you like pen and paper, an app, or a spreadsheet make sure it is documented. My husband and I personally use Google Sheets.

Having a sinking fund will only benefit you and will only work if it’s included in your monthly budget. Treat your savings like an expense/bill and that it MUST be paid every month.

How Many Sinking Funds Should I Have?

Hopefully, I have convinced you to start a sinking fund or funds account in your budget. The number of funds is entirely up to you and your family’s needs/wants. However, you can have too many funds. Which would cause you to not really get anywhere in your savings goal because your monthly savings is being stretched too thin.

Here’s an example of stretching your money a little too thin:

Let’s say you have $500 to split into your sinking funds:

Sinking Fund Categories

- Date Night – $50.00

- Family Vacation – $100.00

- Concert Tickets – $100.00

- Medical Bills – $200.00

- Education – $50.00

By the end of the year, you would have saved up:

- Date Night: $600.00

- Family Vacation: $1,200.00

- Concert Tickets: $1,200.00

- Medical Bills: $2,400.00

- Education: $600.00

Now, they are not bad saving goals. They all have a pretty decent amount in them. But there is a better and more efficient way to do this.

Imagine needing $ 5,000.00 for a hospital bill because you are expecting a new addition to the family. The current setup will only have $2,400.00 by the end of the year. If you were to reallocate concert tickets, family vacation, and date night you can have over $5000.00 saved up.

So instead it’ll look like this by the end of the year:

Sinking Fund Categories:

- Medical Bills – $5,400.00

- Education – $600.00

Prioritize what and when do need to have a certain amount. If you are expecting a baby by the end of the year, saving for medical bills before saving for a family vacation will allow you to achieve your goal much faster.

Don’t stretch yourself or your money too thin, do the math, and then slowly and diligently put money towards that goal. Nothing says you can’t restart the date night, family vacation, and concert tickets sinking funds the following year.

Make sure a BIG purchase doesn’t derail your goals

Having patience (especially in today’s society) truly is a talent. We live in an “I want it NOW!” environment and every company will prey upon that. We have unlimited access to various lines and types of credit probably now more than ever with everyone wanting our business.

I personally fell victim to this and now, my husband and I are in the process of trying to get out of $18,000 worth of credit card debt. Yes, that is just the total of our credit cards and IT SUCKS! However, with diligence and a couple of sinking funds, we will be debt free soon.

If you have a little patience and discipline, you’ll have something most people and I don’t. And that is, No worries.

Saving a little each month will have you prepared, stress-free, and not broke every time something comes up. Start a sinking fund account and reach your saving goals today!

This post was all about how sinking funds can keep you out of debt.

One Comment

Comments are closed.