This site may contain affiliate links, view the Disclaimer for more information.

The 70/20/10 rule budget takes the confusion and frustration out of budgeting. Especially when looking up anything related to money, it seems to be targeted towards other money gurus. Most of us have families and just want a simple way to track our income and tackle debts.

Disclaimer: I am not a financial advisor or advising you on what to do with your money. Everything on this site is for educational purposes. I simply share a budgeting style currently working for me and my family. Contact your advisor if you need further assistance.

Look, I get it. I am a SAHM to two kids under 5 and a wife. It’s part of my job to handle our family’s budget (somehow my husband trusts this haha). So I needed a simple and effective budget to achieve all our goals.

I stumbled across the 70/20/10 budget and instantly fell in love. It was perfect to still have fun in life and tackle debts. I felt other financial gurus (ahem, Dave…) were entirely too strict and almost miserable.

However, the way I budget will be tweaked a little bit. While I believe in tackling debts as quickly as possible, I don’t believe in not saving or having zero fun while doing so. I’ll explain that thought later in the post.

This post is all about how to budget using the 70/20/10 rule budget.

70/20/10 Budget Rule

First off, what is the 70/20/10 Rule Budget?

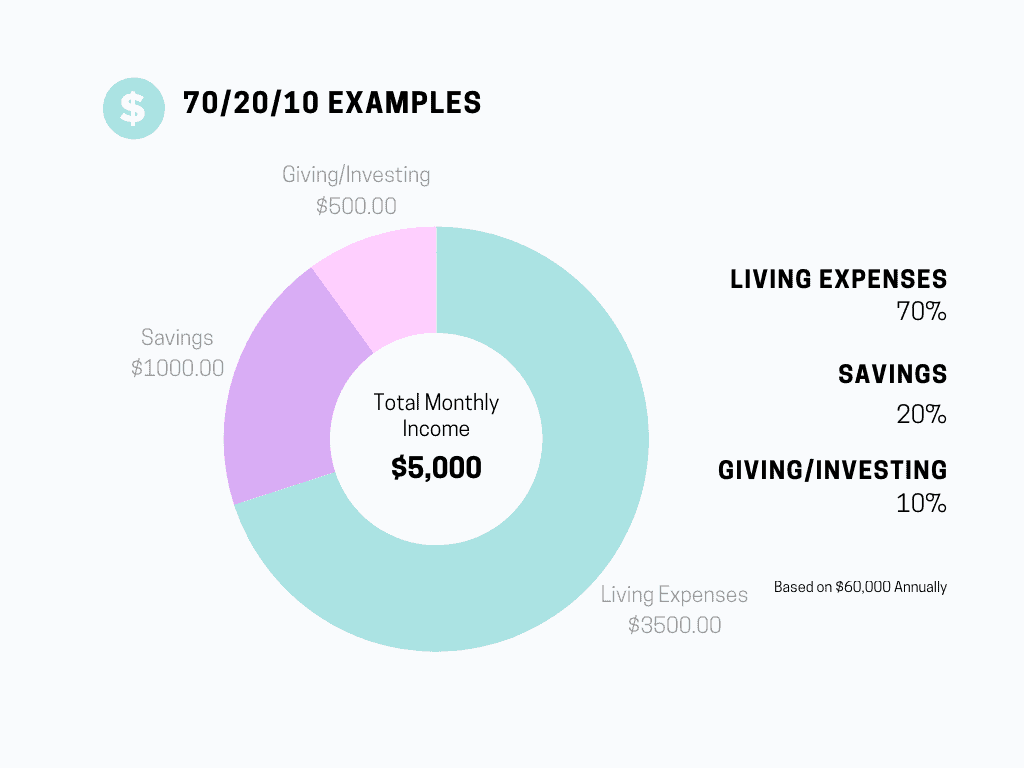

This budgeting model allocates your monthly income as percentages. This means 70% of your income is allocated to everyday spending and living expenses. 20% of your income goes towards savings and 10% of your income is allocated towards giving/investing. It’s a spin on the 50/30/20 budgeting model but more flexible.

However, certain financial gurus will have you take your 20% and your 10% and have that all tackle debts after you save up an emergency fund. Depending on what you want to do, the 20% and the 10% can be your debt payoff strategy. However, I’d recommend saving at least 5-10% for yourself.

[Related Post: Emergency Savings: 11 Reasons Why You Need a Plan]

Breakdown of the 70/20/10 Budget:

What are Living Expenses? (The 70%)

Everyone has different expenses to maintain their lifestyle. However, there are some universal expenses. Some examples:

There are other living expenses that others may not have but would fall under this category:

Whatever you need to keep the household running without any hiccups would fall under 70%. This is where you would start to trim any unnecessary bills out to fit under the 70% umbrella. The good thing about the 70% is that it is 100% up to you what bills you keep.

Savings could go under this amount as a “living expense” so that way you can still save and use the 30% as debt money. More on that later.

What goes under Savings? (The 20%)

While everyone will have different needs when it comes to savings, everyone should have at least three: Short-term savings, Long-term savings, & Sinking Funds.

Short Term Savings

Short-term savings could be a new family car, a family vacation, or a new mattress. This savings account would be allocated funds for any purchases made within the year.

Long Term Saving

Long-term savings could be a new home, home additions, retirement, or education. This savings account would be allocated funds for any purchases made 12 months or later after opening the account.

Sinking Funds

Sinking funds has to be my favorite way to save money. The easiest way to explain sinking funds is that they remind me of small money challenges. For example, the holidays are the biggest spending season for most people.

In September, you should be putting money away for Christmas. So you would have a savings fund dedicated just for Christmas. My goal is to start a sinking fund for my daughter’s joint birthday party.

So about three months from the event, I will start putting away money for their birthday party. It will cover the decorations, food, venue, and any gifts for them. Yes, even though I have debt to tackle I also have a family and a life to live.

Can I still tackle debt while saving?

ABSOLUTELY!

Savings goals help get rid of the need to get into further debt while tackling debt and still living a life. You can decide how much or how little you should save. Whatever the amount you choose you should always save something.

That is a lesson my parents instilled in us (even though I have struggled haha). You could split it down the middle. Save 10% and use the other 10% to tackle debt. Whatever helps your family live and become financially free.

What goes into Giving or Investing? (The 10%)

This is another lesson that I think financial gurus are too hard on. While I don’t disagree with tackling debt as fast as you can. Again, life will still life.

Most will have you give or invest AFTER you’ve gotten rid of most if not all your debts. But I always thought, what if?

- What if it took you 10 years to get out of debt? That’s ten years of having no money invested.

- What if you could help someone today by buying a meal? So, I can’t even help someone this one time?

- Or now I can’t give to my church or organization?

I think it all depends on how bad your financial health is. If you somehow managed to get into 1.5 million dollars in debt, then yeah buddy you had all the fun you are going to have for a while. Sell everything but your clothes.

But if you are in 40K in the hole, you could just save less than you’d like and still have fun. My husband and I still have “fun” money every month because I refuse to be miserable. However, I have a budget and I am sticking to it. Once the fun money is gone, it’s gone. Bill money is not a substitute or backup.

Some Investing Ideas:

70 20 10 Budget Rule Example

Step 1: Have a Budgeting Template & System

This planner has a savings tracker, a budget tracker, and a plan to tackle debt! (Will also help you in other areas of your daily life.)

Step 2: Calculate Your Take-Home Pay(Not Your Gross) (70%)

We need to calculate exactly what we are working with. How much do you have after taxes, 401K contributions (you are contributing, right?), health and life insurance, and everything else with its hand out?

For example: You bring home $2500 a month after deductions. Your deductions include state and Federal taxes, health insurance, dental insurance, and life insurance. Leaving you with a solid $2500 to work with.

70% of $2500 = $1750

Step 3: Establish A SAving(s) Goal (10%)

I was taught to pay myself first. Now, sometimes I will treat myself first but that’s beside the point. Your savings goals are important. The question is, what are you saving for?

Whatever the goal may be, you need to create a plan. And ideally, set up a separate “can’t touch” savings account. However, things happen and plans get derailed. If possible, open a high-yield savings account.

10% of $2500 = $250

Step 4: Create a Debt Repayment Plan (20%)

There’s the debt snowball and the debt avalanche as the two most popular debt payment methods. I personally love and use the debt snowball.

However, you choose whatever debt method works for you and your budget. There is no right or wrong way, just find a way.

20% of $2500 = $500

Step 5: Look Back At The Last 3 Months of Spending

You’ll be able to see a pattern in your spending. My husband and I ate our money away. All I saw was Wendy’s, Mcdonalds, Arby, Chipotle, Texas Roadhouse, Olive Garden and the list goes on. This forced us to open our eyes and realize how much money we wasted.

This will also allow you to see your recurring bills, any quarterly bills (I pay pest control every 3 months), and bi-weekly bills. You’ll want to record them on your budget tracker.

Record your “must be paid” expenses towards the top. Such as:

Step 6: Track Your Spending

Write down every transaction and every penny you spend, move, or look at funny. Some people use tracking apps, spreadsheets, or even pen and paper. Use whatever is easiest to encourage you to track your spending.

Step 7: Evaluate and Adjust Your Plan

I look over our budget once a month and every week. Make it an event or a date night to talk about what’s working and what isn’t. Be honest with yourself about your wants and needs to stay within the 70%. How bad is your debt-to-income ratio?

A plan only works as well as the systems that support it.

[Post you may like: Quick Guide: How to Create the Ultimate Productivity System to Reach Your Goals]

However…

Let’s clear the air on something, the thing I love about budgeting is that there is not a one-size-fits-all. It’s highly customizable to fit individual needs. If you want to tackle debt as quickly as possible then by all means live off that 70% and use the 30% to go towards debt.

Don’t feel pressured to give to an organization. If your heart isn’t in, then that defeats the purpose of giving. You have full control of your money and where it goes. Giving is personable.

I would suggest having at least 1 month of expenses or at least $2,500 saved as an emergency fund before doing so. Because say it with me “LIFE WILL STILL LIFE!” And I would hate for you to find yourself needing to use debt after an emergency.

This post is all about creating a budget using the 70/20/10 rule budget.